claim workers comp taxes

We encourage the injured worker and employer to work together when completing the form. However the government does not look at workers comp in the same way that it looks at actual wages earned.

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Call the Princeton work injury lawyers at Lependorf Silverstein PC.

. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. Download and fill out the Wyoming Report of Injury form completely. While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms.

Even professional tax preparers wading through the newest rules are scratching their heads. Email or phone Password. IRS Publication 525 pg.

We Are Dedicated To Your Rights. Since your previous monthly income was 2500 that sum. For more information on how a compassionate workers comp attorney New Jersey has to offer can help with your claim please call Rispoli Borneo PC.

Most workers compensation benefits are not taxable at the state or federal levels. And so some people wonder why it is that you only receive two thirds of. According to the IRS you do not have to pay income taxes on benefits paid under workers compensation.

A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax. A travel tax deduction on workers compensation can also be claimed for the distance traveled from your doctor to the paying authority and back home. Matt Harbin is a workers compensation attorney in North Carolina at the Law Offices of James Scott Farrin.

See reviews photos directions phone numbers and more for the best Workers Compensation Assistance in Montvale NJ. Sign in to save Claims Adjustor 1 at Coventry Workers Comp Services. However a portion of your workers comp benefits may be taxed if you also receive Social.

Apply to Office Worker and more. At 609 240-0040 for help. Need help with your NJ workers compensation claim.

At least 1-3 years of experience in medical field handling workers compensation claims. Fortunately we have some good news. Workers comp is a benefit system.

Well Im happy to report that workers compensation payments are fully tax-exempt under federal law. If injured at work you are entitled to appropriate medical care and compensation. No workers compensation benefits are not taxable at either the federal or the state level theyre generally.

For example if you. Get Access to the Largest Online Library of Legal Forms for Any State. Ad Injured at work.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. He received the Order of Service award from the North Carolina. Print and mail to the address.

If your tax adviser wants to know the amount you can explain that the benefits. Do I have to Pay Taxes on Workers Comp Benefits. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Yes you can but you dont always have to. Skip to content Call us for a. Bramnick Rodriguez Grabas Arnold Mangan LLC helps injured employees in Clifton NJ file workers compensation claims for benefits.

The following payments are. In fact IRS publication 907 states in pertinent part. Jack Stillman is an experienced workers compensation attorney.

Ad If You Have Been Injured On The Job You May Be Entitled To Compensation. Call Our Team Today For A Free Legal Consultation. Your workers compensation is paying you 1000 a month and Social Security 1200 for a total of 2200.

First even though you dont always have to pay taxes on most workmans comp sometimes you may have to report it to the IRS. In most cases workers comp payments dont count as. The quick answer is that generally workers compensation benefits.

How To Deduct Workers Compensation From Federal Tax Form 1040

Workers Compensation Benefits And Your Taxes 2022 Turbotax Canada Tips

Workers Compensation And Taxes James Scott Farrin

Is Workers Compensation Taxable In North Carolina Riddle Brantley

When Does Workers Comp Start Paying Benefits Or When They Should

Taxes On Stocks How Do They Work Forbes Advisor

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Is Workers Compensation Taxable Klezmer Maudlin Pc

Workers Compensation And Taxes James Scott Farrin

What Can Independent Contractors Deduct

Is Workers Comp Taxable No Unless

In The Event Of An Injury Employees Can Claim Workers Comp In Florida Employers Are Bound By Law To Offer This For I In 2022 Workplace Injury Employment How To Plan

Are My Workers Comp Benefits Taxable In Massachusetts

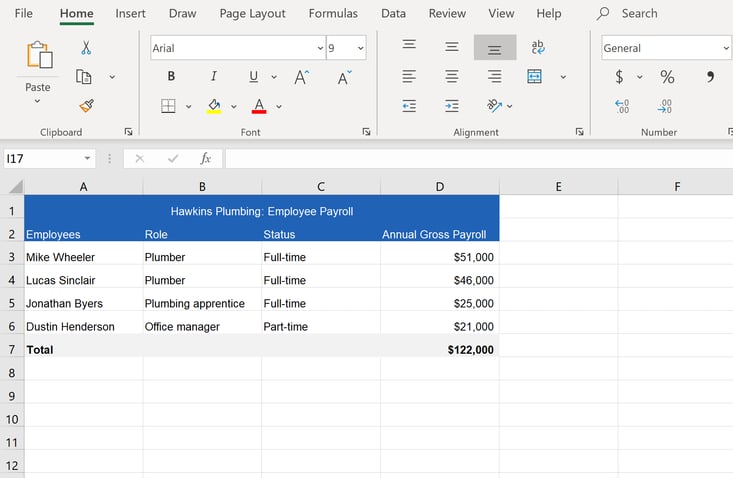

How To Calculate Workers Compensation Cost Per Employee

Is Workers Comp Taxable Workers Comp Taxes

Is Workers Comp Taxable Hourly Inc

Pin On Workers Compensation Claim

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump